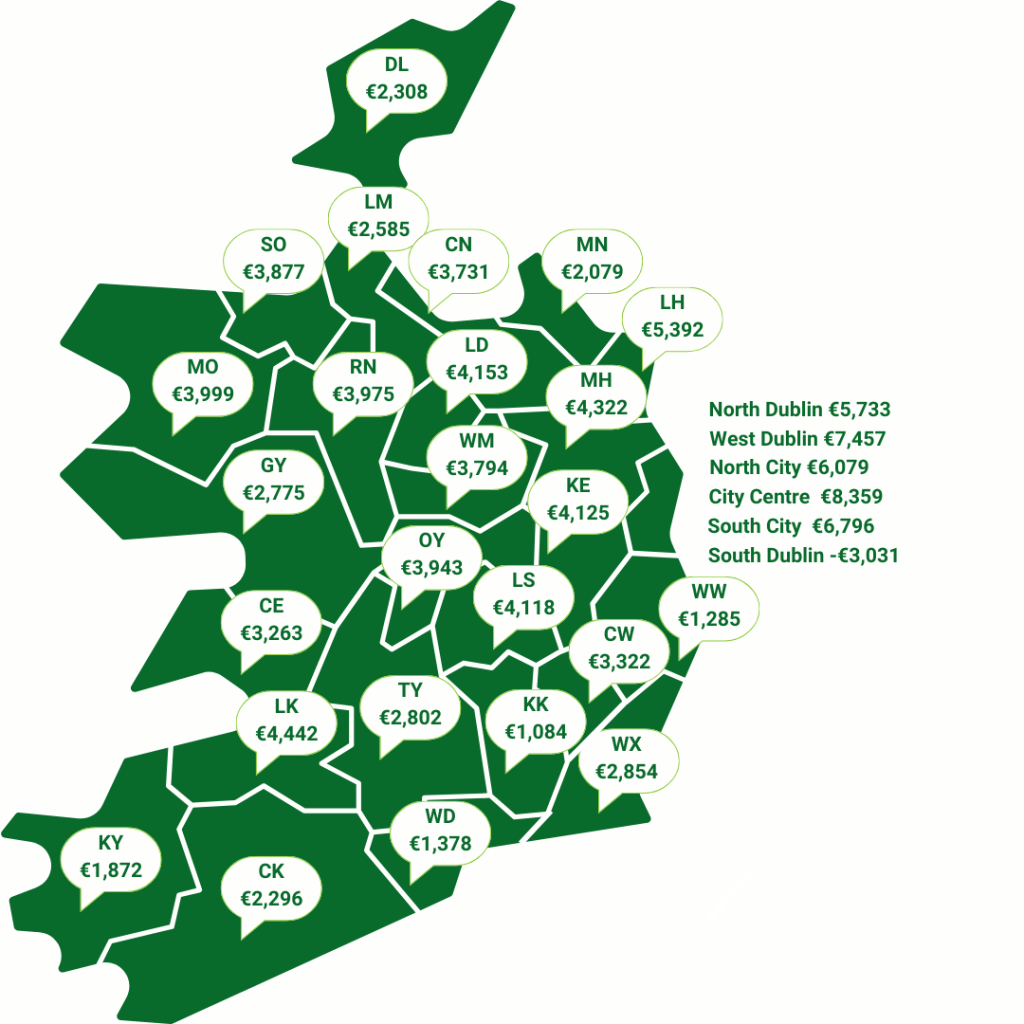

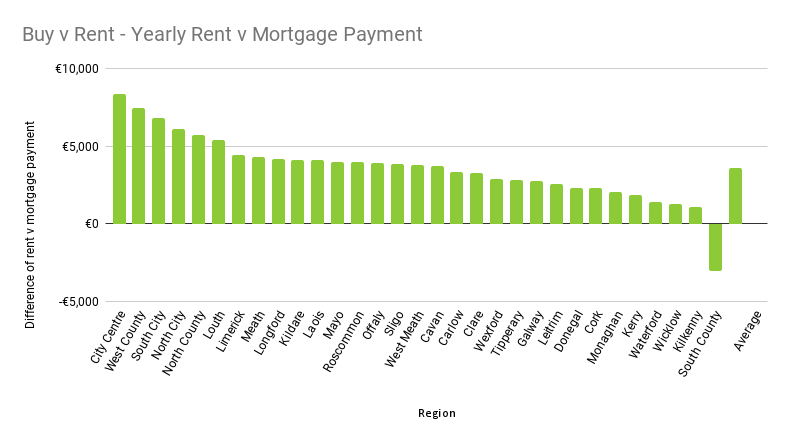

moneysherpa.test.inview.ie analysed how rents now compare to the equivalent monthly mortgage payments on the same properties region by region. The average renter will now pay €3,588 a year more than a buyer taking out a 90% loan to value mortgage on the same property.

Significant Differences In Savings Across Ireland

The analysis found that in Dublin, Louth, Limerick, Kildare, Meath, Longford and Mayo renters were paying an average of €4,000 more a year than buyers. With City Centre Dublin showing the highest difference at €8,359 more in rent paid each year and all areas of Dublin paying over €5,700 more versus the repayments on a 90% mortgage on the same property.

The only region in the country where rents are actually lower than mortgage repayments is South County Dublin, where renting is over €3,000 cheaper a year than buying.

South County Dublin was very much the exception though, in all other regions buying saves at least €1,000 a year compared to renting.

moneysherpa.test.inview.ie yearly average saving in mortgage payments v rent per region

Buy v Rent Calculator

moneysherpa.test.inview.ie has also developed a free online calculator below that can be used to calculate how your own monthly rent would compare to a mortgage repayment.

Renters Being Hit Hardest by Housing Crisis

The moneysherpa analysis indicates that renters are those being worse hit by the housing crisis. With a shortage of new rental supply driving a 8.0% increase in rents year on year combined with strict mortgage lending limits locking out renters from buying.

The Irish Central Bank imposed lending limit of 4.0 times salary is one of the strictest lending caps in Europe, with would-be buyers being forced to continue renting as they are unable to get a mortgage due to the bank’s rules.

Even if a would be buyer hurdles the Central Bank limits they then face lenders with some of the highest rates and strictest credit policies in the world.

Creative Solutions Needed

This analysis raises some significant questions about the current mortgage lending rules, which are creating a chasm between those who can get a mortgage and those that can’t.

Those that can, pay over €100,000 less to live in their home over 30 years and then own a home that they can pass onto to their family if they wish. Those that can’t, pay over €100,000 more over 30 years and have nothing to show for it.

The government, regulators and lenders need to develop more creative solutions to help trapped lenders get on the property ladder.

The idea that expanding grants or relaxing credit rules will inflate housing costs or result in unsustainable repayments is misguided, housing cost inflation and unsustainable repayments are already here in the form of sky high rents.

Relaxing mortgage rules or increasing the scope of grants will simply allow more people to own their own homes and become financially secure.

Average regional rents, house prices and monthly mortgage repayments.

moneysherpa.test.inview.ie analysis of Monthly Rent v Mortgage Payments

| Region | House Price | Monthly Rent | Monthly Mortgage | Monthly Difference | Yearly Saving | |

| City Centre Dublin | €372,616 | €2,317 | €1,620 | €697 | €8,359 | |

| West County Dublin | €362,998 | €2,200 | €1,579 | €621 | €7,457 | |

| South City Dublin | €468,106 | €2,602 | €2,036 | €566 | €6,796 | |

| North City Dublin | €403,654 | €2,262 | €1,755 | €507 | €6,079 | |

| North County Dublin | €386,368 | €2,158 | €1,680 | €478 | €5,733 | |

| Louth | €279,305 | €1,664 | €1,215 | €449 | €5,392 | |

| Limerick | €251,517 | €1,464 | €1,094 | €370 | €4,442 | |

| Meath | €334,074 | €1,813 | €1,453 | €360 | €4,322 | |

| Longford | €197,280 | €1,204 | €858 | €346 | €4,153 | |

| Kildare | €340,148 | €1,823 | €1,479 | €344 | €4,125 | |

| Laois | €248,082 | €1,422 | €1,079 | €343 | €4,118 | |

| Mayo | €212,869 | €1,259 | €926 | €333 | €3,999 | |

| Roscommon | €206,672 | €1,230 | €899 | €331 | €3,975 | |

| Offaly | €253,727 | €1,432 | €1,103 | €329 | €3,943 | |

| Sligo | €205,559 | €1,217 | €894 | €323 | €3,877 | |

| West Meath | €272,679 | €1,502 | €1,186 | €316 | €3,794 | |

| Cavan | €217,320 | €1,256 | €945 | €311 | €3,731 | |

| Carlow | €265,638 | €1,432 | €1,155 | €277 | €3,322 | |

| Clare | €243,078 | €1,329 | €1,057 | €272 | €3,263 | |

| Wexford | €288,854 | €1,494 | €1,256 | €238 | €2,854 | |

| Tipperary | €240,645 | €1,280 | €1,047 | €233 | €2,802 | |

| Galway | €280,701 | €1,452 | €1,221 | €231 | €2,775 | |

| Leitrim | €185,701 | €1,023 | €808 | €215 | €2,585 | |

| Donegal | €213,782 | €1,122 | €930 | €192 | €2,308 | |

| Cork | €291,262 | €1,458 | €1,267 | €191 | €2,296 | |

| Monaghan | €233,349 | €1,188 | €1,015 | €173 | €2,079 | |

| Kerry | €269,736 | €1,329 | €1,173 | €156 | €1,872 | |

| Waterford | €317,139 | €1,494 | €1,379 | €115 | €1,378 | |

| Wicklow | €413,431 | €1,905 | €1,798 | €107 | €1,285 | |

| Kilkenny | €303,694 | €1,411 | €1,321 | €90 | €1,084 | |

| South County Dublin | €656,409 | €2,602 | €2,855 | -€253 | -€3,031 |